Are you thinking of buying your first home, moving up, or looking at that vacation home but aren’t sure if you should get into the market now or wait? It’s no secret that the cost of living keeps going up. Not only are prices for all goods increasing steadily, but inflation continues to dominate the headlines right alongside the seemingly vertical rise in Canadian mortgage rates. Let’s face it, the cost to borrow money has increased significantly since the pandemic and the days of the super low mortgage rates are behind us.

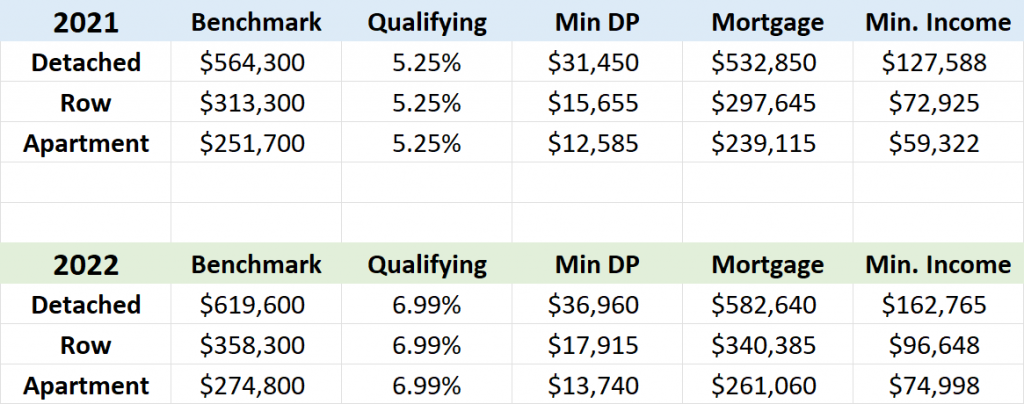

From 2021 to 2022, we saw the minimum mortgage stress-test rate increase from 5.25% to 6.99%. At the same time, we saw the price of your average single family detached home in Calgary increase from $564,300 to $619,600.

The above proves that if you didn’t buy in 2021 and waited until 2022, you would have needed a raise of $35,177 year-over-year just to purchase the same property. With rates having stabilized and with prices set to stabilize before resuming their gradual march upwards, it makes the most sense to get into a property as soon as possible and before mortgage rates, inflation, or out of the market.

To buy or to wait has never been more clear. Waiting now will only cause to you to either pay more later or purchase less than you could if you became a homeowner today!

If you have any questions around this policy, or any mortgage related questions, please reach out to your favorite Advanced Mortgage professional or email us at info@advancedmortgage.ca

-The Advanced Team