Car Payments & Mortgage Application

After your mortgage/rent payment, car payments are most often the second-highest monthly debt that Canadians incur. When calculating your affordability for a mortgage, every potential lender looks at an applicant’s TDS (Total Debt Service ratio) which is your monthly debts divided by your monthly income. THE average TDS maximum is 43.99%. If we cannot get the TDS below this number, a mortgage approval cannot be issued.

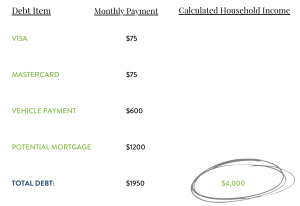

Example: This applicant’s TDS would be 48.75% (1950/4000) and they would not qualify for their new home as the ratios need to be under 44% to be approved.

Options: Increase income, increase down payment, or decrease debt.

If we could get the car payments down from $600/m to $350, the TDS would fall to 42.5% and the client would qualify for their new home!!

With many new buyers, increasing income or down payment is not an option so reducing debt is our #1 course of action.

With vehicle leases, we have partnered with Finch Financial to help Canadians lower their vehicle costs and increase their affordability.

Vehicles are sold with “payments” more than the price or interest rate of financing. Anyone that has purchased a vehicle knows the weekly payment before they know the rate or the final purchase price.

Lenders amortize the debt over a LONG period of time (7-10yrs) to sell the perceived affordability on the new vehicle

Buyers are not aware that the longer the amortization, the higher the rate (in most instances)

Payments are sold weekly to add additional perceived benefit

Rates are anywhere from 0%-9%, depending on credit score, new/used vehicle, etc

What we do is investigate the Rate and Amortization. We reduce the rate of the financing or extend the term of the debt to lower the minimum payment. We get the payment reduced, increasing the client’s affordability, and qualify them for a home!!

So, if you or your clients are thinking:

- “I have to wait to sell my car before buying a home”

- “My car payment is too high to qualify for a house right now”

You now have a solution!!!

Advanced Mortgage Team